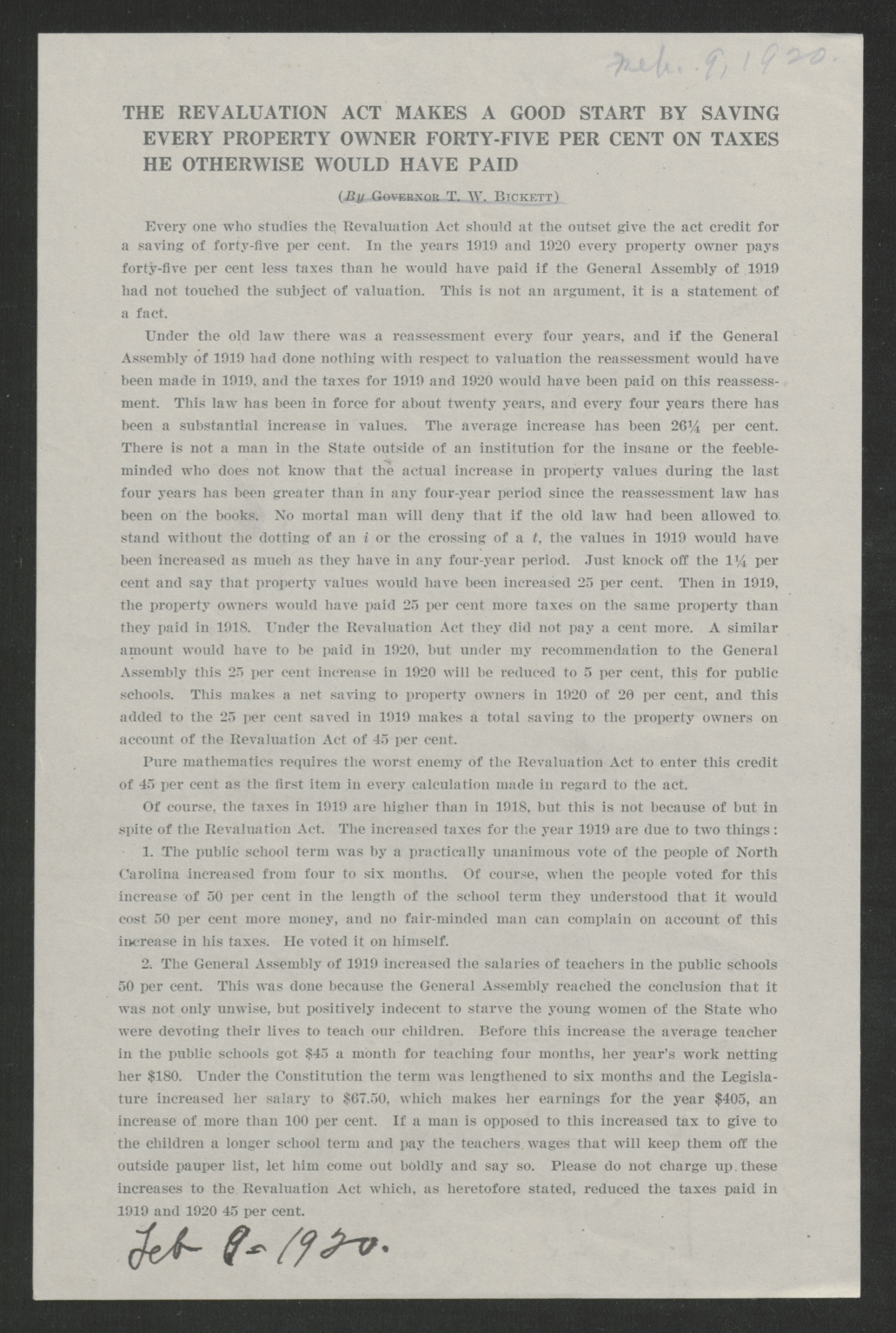

Feb. 9, 1920.

THE REVALUATION ACT MAKES A GOOD START BY SAVING EVERY PROPERTY OWNER FORTY-FIVE PER CENT ON TAXES HE OTHERWISE WOULD HAVE PAID

(By Governor T. W. Bickett)

Every one who studies the Revaluation Act should at the outset give the act credit for a saving of forty-five per cent. In the years 1919 and 1920 every property owner pays forty-five per cent less taxes than he would have paid if the General Assembly of 1919 had not touched the subject of valuation. This is not an argument, it is a statement of a fact.

Under the old law there was a reassessment every four years, and if the General Assembly of 1919 had done nothing with respect to valuation the reassessment would have been made in 1919, and the taxes for 1919 and 1920 would have been paid on this reassessment. This law has been in force for about twenty years, and every four years there has been a substantial increase in values. The average increase has been 26 1/4 per cent. There is not a man in the State outside of an institution for the insane or the feeble-minded who does not know that the actual increase in property values during the last four years has been greater than in any four-year period since the reassessment law has been on the books. No mortal man will deny that if the old law had been allowed to stand without the dotting of an i or the crossing of a t, the values in 1919 would have been increased as much as they have in any four-year period. Just knock off the 1 1/4 per cent and say that property values would have been increased 25 per cent. Then in 1919, the property owners would have paid 25 per cent more taxes on the same property than they paid in 1918. Under the Revaluation Act they did not pay a cent more. A similar amount would have to be paid in 1920, but under my recommendation to the General Assembly this 25 per cent increase in 1920 will be reduced to 5 per cent, this for public schools. This makes a net saving to property owners in 1920 of 20 per cent, and this added to the 25 per cent saved in 1919 makes a total saving to the property owners on account of the Revaluation Act of 45 per cent.

Pure mathematics requires the worst enemy of the Revaluation Act to enter this credit of 45 per cent as the first item in every calculation made in regard to the act.

Of course, the taxes in 1919 are higher than in 1918, but this is not because of but in spite of the Revaluation Act. The increased taxes for the year 1919 are due to two things:

1. The public school term was by a practically unanimous vote of the people of North Carolina increased from four to six months. Of course, when the people voted for this increase of 50 per cent in the length of the school term they understood that it would cost 50 per cent more money, and no fair-minded man can complain on account of this increase in his taxes. He voted it on himself.

2. The General Assembly of 1919 increased the salaries of teachers in the public schools 50 per cent. This was done because the General Assembly reached the conclusion that it was not only unwise, but positively indecent to starve the young women of the State who were devoting their lives to teaching our children. Before this increase the average teacher in the public schools got $45 a month for teaching four months, her year's work netting her $180. Under the Constitution the term was lengthened to six months and the Legislature increased her salary to $67.50, which makes her earnings for the year $405, an increase of more than 100 per cent. If a man is opposed to this increased tax to give to the children a longer school term and pay the teachers wages that will keep them off the outside pauper list, let him come out boldly and say so. Please do not charge up these increases to the Revaluation Act which, as heretofore stated, reduced the taxes paid in 1919 and 1920 45 per cent.

Feb 9 - 1920.